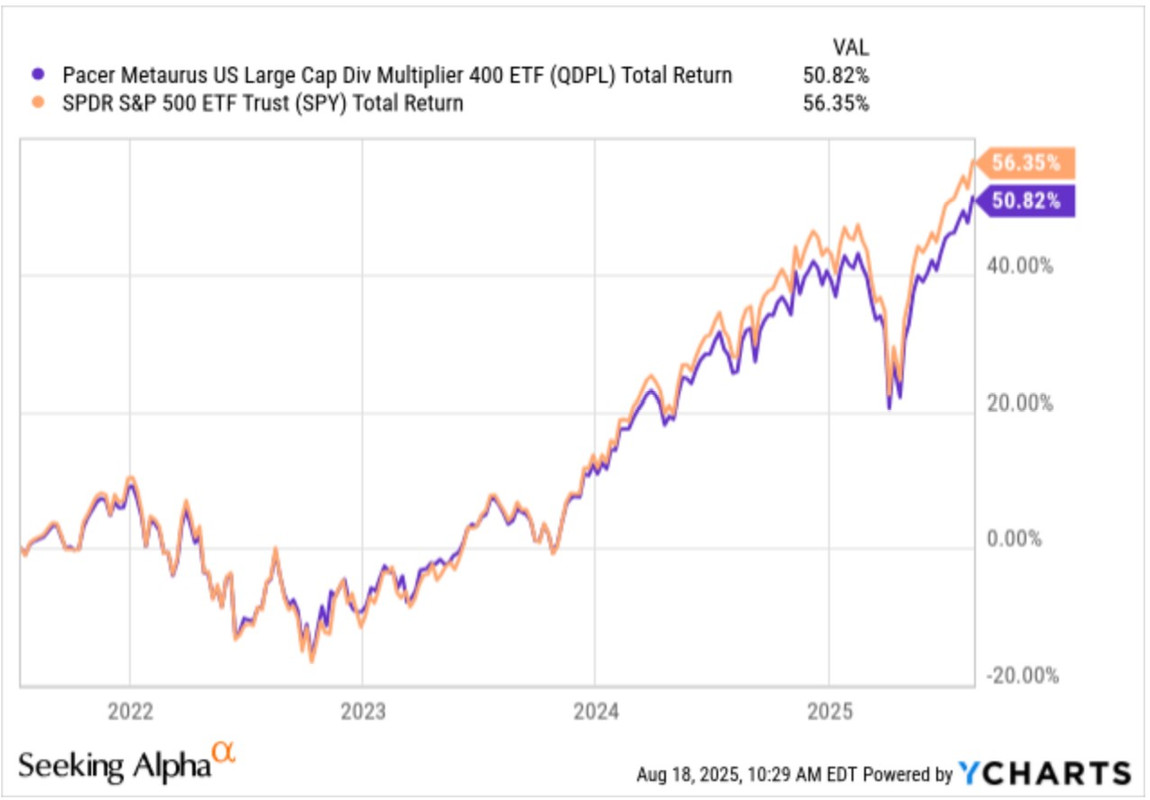

One of most popular income generation strategies used by multiple funds are covered call. But one major disadvantage with covered call strategy is capped upside growth. QDPL provides a unique 4x dividend approach without the price cap trade off.

"About 90% invested in S&P 500 stocks (US large cap), but be careful, it does not do stock-picking. The index is always the S&P 500."

"400% exposure to dividends through S&P Dividend Futures (futures renewed every December). To achieve this, it invests the remainder in Treasuries, which it will use as collateral to buy futures on a larger notional."

"So we are talking about "dividends risk": dividends are not guaranteed; in case of recession or cuts, the fund underperforms. And if dividend growth is lower than expectations, there is a risk of underperformance."

https://seekingalpha.com/article/481507 ... %20Futures.

There are also tax benefits with this fund.

SPY yield: 1.11%

QDPL yield: 5.48%

YMYD